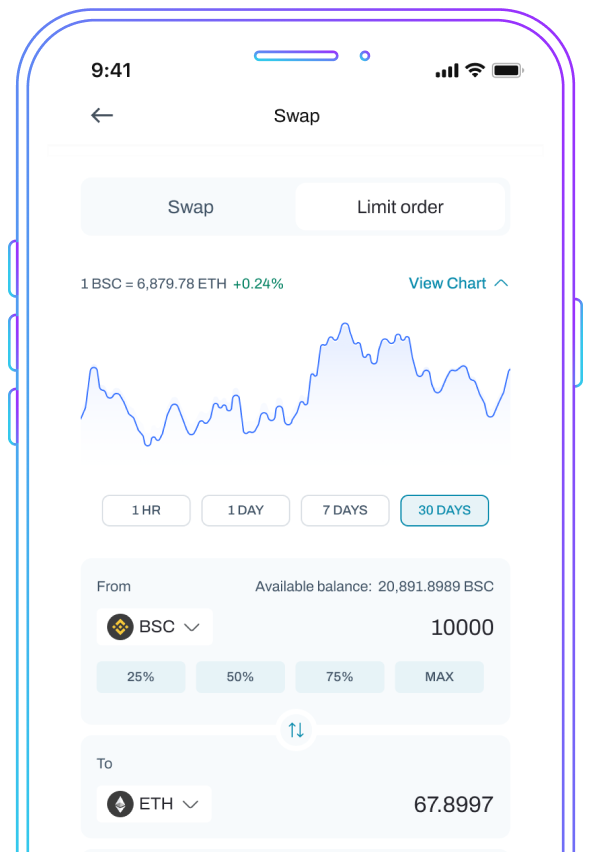

Buy or sell cryptocurrencies at your desired price.

Set your price, sit back, and let us handle the rest.

Set Your Price

Specify the price you want to buy or sell a cryptocurrency at.

Wait For Price Target

Relax while we monitor the market for your price target.

Automatic Execution

Once the market hits your desired price, your order is executed automatically.

Why Use Our Limit Order?

User-Friendly Interface

Set up and manage your limit orders with our easy-to-use platform.

24/7 Trading

Trade around the clock without being tied to your screen.

Increased Control

Take charge of your trading strategy with precision and efficiency.

Precision Trading

Execute trades at your exact price point, ensuring you get the best deal.

This is how your limit order works: Set Your Price: Specify the price you want to buy or sell a cryptocurrency at. Wait For Price Target: Relax while we monitor the market for your price target. Automatic Execution: Once the market hits your desired price, your order is executed automatically.

Your limit order will be executed when the market price reaches your specified limit price. If the market does not reach your price, the order will remain open until you cancel it or it expires (if you set an expiration date).

Yes, you can cancel your limit order any time before it is executed. Go to your open orders and select the order you wish to cancel.

If your limit order is partially filled, the remaining portion will stay open until the market price reaches your limit price again or until you cancel the order.

A limit order remains active until it is fully executed, cancelled by the user, or reaches its expiration date if one was set. If no expiration date is set, the order will remain open indefinitely.

Yes, you can set multiple limit orders for different prices and amounts.

If your limit order is not being executed, it might be because the market price has not reached your limit price. You can either wait for the market to move to your price or adjust your limit order to a more favourable price for quicker execution.

The primary risk with limit orders is that they might not be executed if the market price does not reach your specified limit price. Additionally, in a rapidly changing market like crypto, the price may quickly move past your limit before the order can be fully executed.